My new home HVAC system!

Dec. 20th, 2024 06:26 pmLawyers: So, lawsuit #1 finally paid out over Labour Day weekend, only 6½ years after my Aunt 𝑨₁ died of neglect at a nursing home. My sister and I got more than the statutory maximum award, even though I never signed a power of attorney for anyone! But it does seem that I’ll have to hire one of those creatures to run the other 𝑨₁–related lawsuits #2, #3, and #4 (if all of them are actually needed).

Financial status: This award has decimated my HELOC personal debt. I now have lots of available credit — but still very little income to repay it with. The Social Security Administration still hasn’t decided whether they will start paying me next year; I was waiting for them to send me a list of requested documents when the Canada Post strike happened.

HVAC: My gas-fired electrically-operated home furnace was 25 years

old and becoming worrisome, so the family decided to spend some lawsuit

credit on replacing it (my kids will be paying the HELOC interest until

Social Security starts). We had been talking to an installer a year ago

about replacing the furnace with a heat pump using various government grants

and loans, but couldn’t quite work things out. So we went back to the same

installer and told them we can now self-fund. On December 10ᵗʰ, we got a

new Napoleon® heat pump and backup gas furnace. That was ten days ago; the

heat pump still isn’t working, so for now we’re getting by with the

replacement furnace (while paying interest on the heat pump).

HVAC: My gas-fired electrically-operated home furnace was 25 years

old and becoming worrisome, so the family decided to spend some lawsuit

credit on replacing it (my kids will be paying the HELOC interest until

Social Security starts). We had been talking to an installer a year ago

about replacing the furnace with a heat pump using various government grants

and loans, but couldn’t quite work things out. So we went back to the same

installer and told them we can now self-fund. On December 10ᵗʰ, we got a

new Napoleon® heat pump and backup gas furnace. That was ten days ago; the

heat pump still isn’t working, so for now we’re getting by with the

replacement furnace (while paying interest on the heat pump).

Ecobee: I was once offered a job at

Ecobee, which I declined. Two years ago, I

got a free Ecobee thermostat for my house through a grant program from my

utility company.

Ecobee: I was once offered a job at

Ecobee, which I declined. Two years ago, I

got a free Ecobee thermostat for my house through a grant program from my

utility company.

We don’t like it. It insists on being connected to the Internet twice

a year, just to deal with Daylight Savings Time (hopefully President Trump

can put a stop to that), and then it takes advantage of the opportunity to

download replacement firmware which makes the user interface less

functional. It seems to be a spy in my house that is not working for me

and I would like to get rid of it.

The HVAC upgrade went fine until connecting the new system to the

existing Ecobee, whose connection display screen (so fancy!) showed all

wires OK except the 𝙾/𝙱 wire was not connected. That wire is used only for a

heat pump, which we didn’t have before. The installer blamed either the

Ecobee or the house wiring and said he could replace them with a Wi-Fi model

for $350.

I do not want my HVAC signals going over radio waves. That’s

needlessly high-tech. I do not want to spend $350 to replace a device I got

for nothing. They are supposed to have 3-year warranties, but the grant

program offers only one year. Other sources say a replacement Ecobee can be

had for $180, but I don’t even want another one.

Honeywell: I checked the websites of area hardware stores and it

seemed that a Honeywell thermostat was the cheapest replacement that would

work for a heat pump backed by a furnace. I contacted Napoleon and they

claimed “any heat pump thermostat” would do, such as the Honeywell. I

bought one on December 13ᵗʰ and installed it. Things did not go well.

Honeywell: I checked the websites of area hardware stores and it

seemed that a Honeywell thermostat was the cheapest replacement that would

work for a heat pump backed by a furnace. I contacted Napoleon and they

claimed “any heat pump thermostat” would do, such as the Honeywell. I

bought one on December 13ᵗʰ and installed it. Things did not go well.

I had to call Honeywell customer support (at night on Friday the ⅩⅢ)

to find out why the config option for the 𝙾/𝙱 wire did not appear. I didn’t

know whether I would need it, but its invisibility was concerning. It

turned out that I had selected the wrong pair of “I have a heat pump” and “I

have a gas furnace” options — with the correct settings, the config option

for reversing the meaning of the 𝙾/𝙱 wire then appears.

That allowed the heat pump to run, but it provided air that was

initially tepid then after an hour it was cold. I tried invoking the

“reverse the 𝙾/𝙱 wire” config option — that made the air positively frigid!

I tried “EM heat” mode, which is documented as bypassing the heat pump and

activating only the furnace. That worked for an hour, then it went back to

the ineffective heat pump while still displaying the “EM heat” mode on the

Honeywell display. This is crazy!

The Honeywell thermostat was unable to regulate the temperature of the

house, so I was forced to reinstall the Ecobee before I could go to bed.

Unimpressive! And the expensive heat pump still wasn’t working, now with

two different thermostats.

The Slough of Despond: The house was warm, so I didn’t have

to do anything over the weekend about the fact that I (or my children)

were paying by the day to own a heat pump that wasn’t helping at all to

reduce our heating cost. I like excuses for not doing anything! Over the

last few years, I have become quite used to the idea that interest charges

just keep racking up day after endless day while I continue to not do

anything about my problems.

The Slough of Despond: The house was warm, so I didn’t have

to do anything over the weekend about the fact that I (or my children)

were paying by the day to own a heat pump that wasn’t helping at all to

reduce our heating cost. I like excuses for not doing anything! Over the

last few years, I have become quite used to the idea that interest charges

just keep racking up day after endless day while I continue to not do

anything about my problems.

On Monday I avoided thinking about next steps, which seemed to involve

testing the 6-wire thermostat cable between basement and living room for

continuity and isolation. How could I possibly do that? I need an ohmmeter

at the furnace and a secondary wire to run down the stairs from the

thermostat. Where can I find that much wire? Eventually I thought of the

100-meter extension cord for my lawn mower, which should be plenty long

enough. Its 120V rating is overspec for this 24V application so I’ll

probably need interfaces at both ends.

On Tuesday I again spent the day avoiding my problem. Eventually I

came up with the connector shown at right. It’s based on a 2-wire grounding

adapter (which some people think is too dangerous and shouldn’t be sold

anymore), a piece of wire, a bolt, a nut, and a clip. I will connect the

clip to one of the thermostat wires and then send the signal downstairs

using the ground wire of the extension cord.

On Wednesday I had a work shift, which provided the perfect excuse to

put things off until dark. Of course, it then took many trips up and down

the stairs to get the

jerry-rig working.

120V contacts tend to get coated with oxides and sulfides, so it doesn’t

work to just shove an ohmmeter probe into the 120V socket — you need an

official 120V connector to scrape the coating. I used the cord from a

laptop power brick. There is a total of 33 Ω of resistance through

one thermostat wire (up to the living room) and one lawnmower ground wire

(back down to the basement).

On Wednesday I had a work shift, which provided the perfect excuse to

put things off until dark. Of course, it then took many trips up and down

the stairs to get the

jerry-rig working.

120V contacts tend to get coated with oxides and sulfides, so it doesn’t

work to just shove an ohmmeter probe into the 120V socket — you need an

official 120V connector to scrape the coating. I used the cord from a

laptop power brick. There is a total of 33 Ω of resistance through

one thermostat wire (up to the living room) and one lawnmower ground wire

(back down to the basement).

I was eventually able to determine that all six wires in the cable are

just fine. They pass through from end to end and are not connected to each

other internally. Good news! I do not need to run a new thermostat cable

nor switch to a radio connection. Next thing to do is get the installer to

come back and look at the heat pump.

On Thursday I continued to avoid my problems.

On Friday I called the installer. He refuses to come back and tells

me to reinstall the Honeywell and give the air pump more time. It could

blow cold air for up to 10 minutes during a defrost cycle! He has nothing

to say about EM mode. I’m thinking I may have to file a warranty complaint

with Napoleon.

More news later!

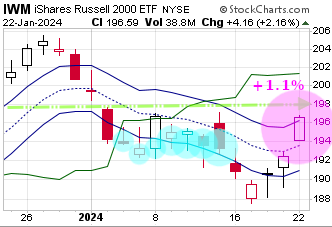

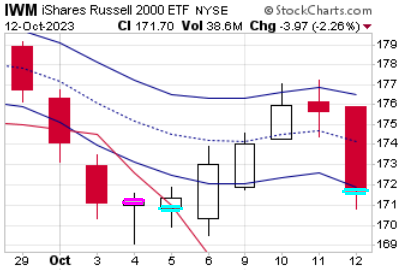

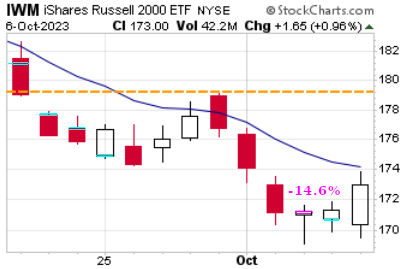

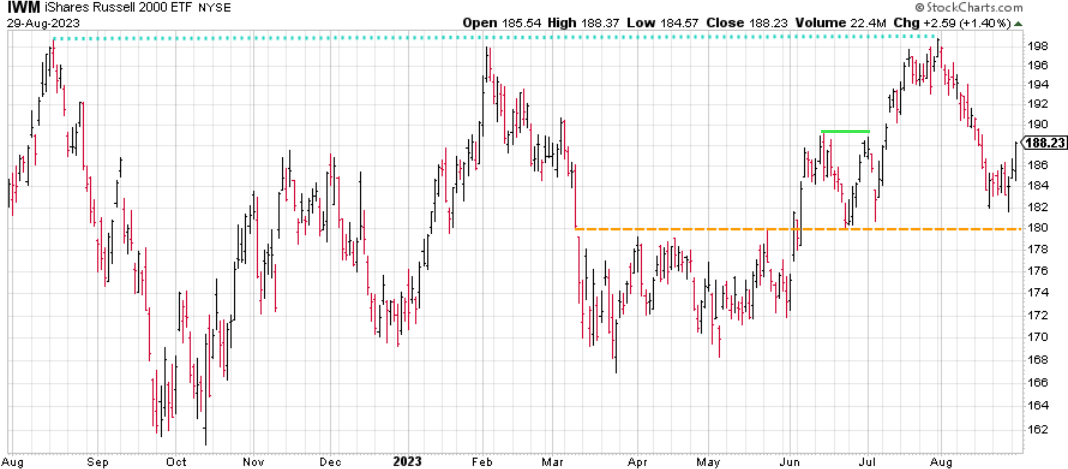

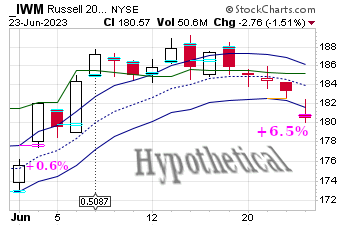

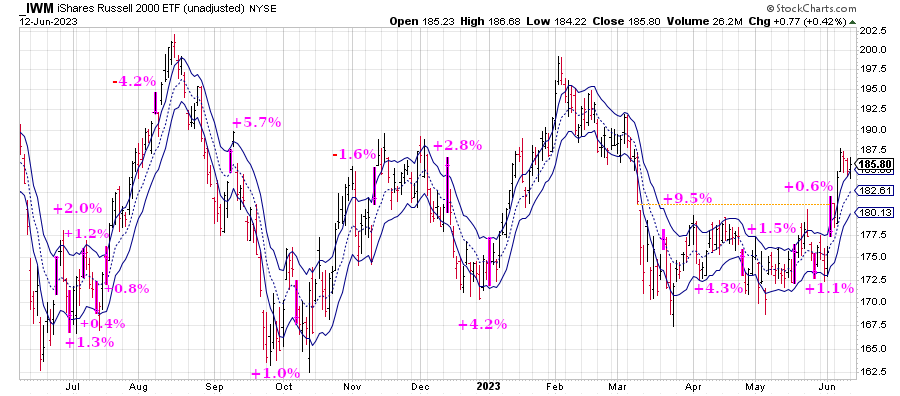

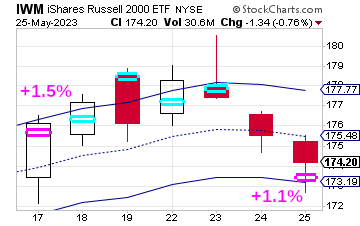

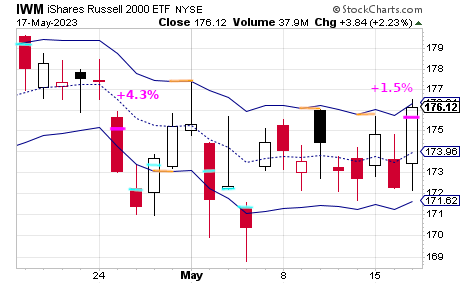

I am raising my bet to 180% short. While the market heaves up and down, I

keep short-selling at roughly the same price. Hey look, it’s a series of

lower highs — what more of an excuse do you want? And we didn’t

bounce off the upper lime-green line, which is bearish.

I am raising my bet to 180% short. While the market heaves up and down, I

keep short-selling at roughly the same price. Hey look, it’s a series of

lower highs — what more of an excuse do you want? And we didn’t

bounce off the upper lime-green line, which is bearish.

Isn't it gorgeous? Blogger Tim Knight

Isn't it gorgeous? Blogger Tim Knight