A Difficult Hobby

Aug. 1st, 2025 11:57 pmYep, this is a stock-trading post. Let’s have an orderly exit from our seats, please. Children and the handicapped first. There’s no need to block the aisles. Please latch your tray-tables in their full upright positions.

tl;dr Of course you don’t want to read this, so I’ll just summarize:

I still have that imaginary IWM short that I mentioned

last time; it has

been doing poorly. Meanwhile, I have completed several TNA long

trades (all imaginary) that went okay, followed by one that went badly and

dropped my account value by 20% for a time — then, using the seat of my

pants, I was able to keep the realized loss to only

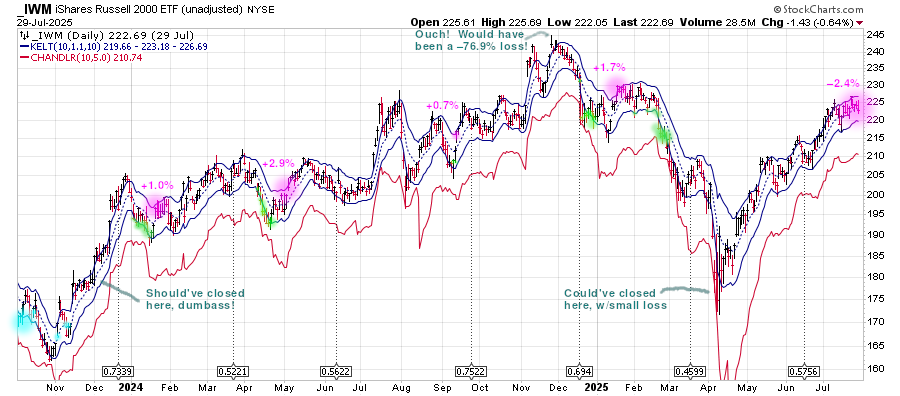

Let’s start with the recent history. At the beginning of 2025, I decided to pull my old stock-simulator out of moth-balls for some more scenario-testing. It still works because it’s written in Emacs Lisp, which is backward-compatible for 30 years. It seems that widening my Keltner channel to ±1.1 Average True Ranges would lead to larger profits, while shortening the chandelier exit’s window to 10 days and then requiring 4 closes below it before triggering ‘Emergency Stop’ should reduce the number of spurious signals and thus make me more likely to sell when I should. Of course, the “four closes” rule is just arbitrary and will sometimes tell me to sell at the worst possible time — but ya gotta do somethin’!

Unfortunately, the first trade I tried with the new rules was the one shown

above, which began Feb 03. It all started reasonably enough, until the

market took a nose-dive on Feb 21. In accordance with my algorithm, I

continued gamely buying as the market sank. Then I ran out of (imaginary)

money, but the market continued to sink, closing below the red line on Mar

03 and Mar 04, finally coming to a bottom on Mar 13. Then the market price rose

until Mar 24, when it did not hit my blue line and I

did not realize a

This seems to be an intrinsic problem with contrarian Keltner-channel

trading, which happens with any channel-width I choose. Immediately before

the market does a belly-flop, it will sometimes just barely miss the

blue line, then plummet. I just need a good emergency-stop algorithm to

detect and respond to these situations. Unfortunately, no such algorithm

can be perfected. In this case, my current algorithm’s response was to just

hold on, take note of the red-line hit on Apr 04 (but only the third hit,

so still okay), and then sell at the blue line on Apr 23 for

a

On Apr 23, I did not enter the sell order. Instead, I decided to wait for

the dead-cat bounce and sell at the top. But I don’t have an algorithm for

that, so I’ll need to pull this sell-date out of my butt-hole.

The market rose in late April, then again in early June, then again in

early July. Then it just sat there for a month, unable to go up any

further. When should I sell? When should I sell??? I wish I had an

algorithm!

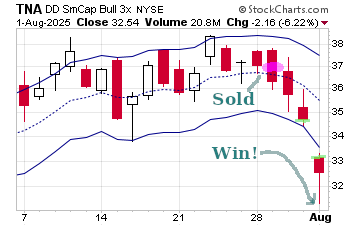

Finally, on Tuesday July 29, I decided it was time. No particular

reason, just too many days with no progress. At 11:01am, at a sale price of

$36.91, I closed my imaginary trade by adding a line to my spreadsheet. I

started writing up this post, but nobody cares so I didn’t think there was

any hurry to prove to you, er, “people” that I really did decide to close

this trade last Tuesday in my spreadsheet.

Finally, on Tuesday July 29, I decided it was time. No particular

reason, just too many days with no progress. At 11:01am, at a sale price of

$36.91, I closed my imaginary trade by adding a line to my spreadsheet. I

started writing up this post, but nobody cares so I didn’t think there was

any hurry to prove to you, er, “people” that I really did decide to close

this trade last Tuesday in my spreadsheet.

Then, the market started dropping. My ass is a very good sell-date

picker — yes, you are! Since Tuesday, the Russell 2000 stock index (which

underlies both IWM and TNA) has lost all its gains for the

preceding month. It has dropped so much that I am… buying again. Yes, it’s

back into the saddle for my algorithm, footloose and buying at the lower blue

line. It feels great to be home after all these months!

Okay, now let’s return to the year 2023. The blue circles are for the still-unclosed IWM short sale, as discussed (poorly) in previous posts. Green and purple circles indicate purchases and sales of long TNA positions in the meantime. I was a dumbass and didn’t close the IWM short in December 2023, even though my ‘Emergency Stop’ function thought that would be a good idea, because the thing cried Wolf! too often and I had started to ignore it. Shown here is the new 2025 style of red line, which hardly ever intersects price (until December 2024) so the intersections will mean more.

My short sale has gone very badly. As of last Nov 25, it had an unrealized

loss of

For 2024, the algorithm entered the market only four times, even though there were a dozen tradeable bull-swings that year. Hopefully this year’s algorithm changes will yield some improvements to the investment returns. For example, we are no longer skipping the first few blue-line hits before starting to buy, which (the stock-simulator says) was not a net positive for profits. Also, the imaginary money-supply is now divided into only 8 days of buying power instead of 12, which juices returns from shorter market swings. But the most helpful thing for juicing returns would be to close the IWM short, which has been hogging 60% of all imaginary money in the account for over a year now. And just getting that thing back to break-even would require a 17% drop in the Russell 2000 index from today’s prices.

Please, Mr. President, your nation is counting on you! Remember that you were elected with an (R) after your name. That means you are obliged to crash the stock market once or hopefully twice during your term, so that your cronies can buy up stock when it’s cheap. Don’t let your fellow plutocrats down! Maybe you could try something totally daft, like a 30% tariff on Canada? And mean it?