A large loss

Lawyers: So, the deposition finally happened last Tuesday, 67 months

after my aunt died. The most surprising thing was the effect of the

1,100-page book on Unicode that I had submitted, which was never mentioned

— but it became my credential as a linguist. When I told them that I

used to have a job finding typos in medical books, despite a lack of

specific training, by “approaching the task as a linguist”, it was like I

had struck gold — I could say anything I wanted about my aunt’s

medical records, even though I couldn’t speak to whether the medicine had

been performed correctly. So I summarized the records as “she died of

treatment delay”, and then mentioned repeatedly the nursing home’s policy

document (which I haven’t actually seen) in which they had said they wanted

to be the kind of home that would call a doctor on a weekend (which they did

not in her case).

My sister gives her deposition this coming week, then some staff from

the home will be deposed by ‘my’ side (who are my opponents on most/every

estate matter other than this wrongful-death lawsuit). I guess that will

all wrap up around American Thanksgiving; then we wait to see whether the

lawyers want a jury trial. Meanwhile, everyone suffers.

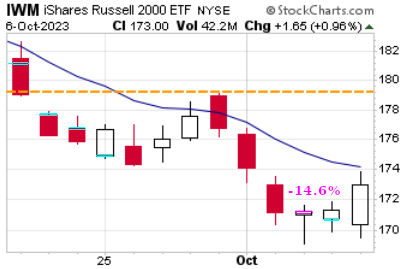

My bullish imaginary bet: Well, that didn’t work out well at all! My

loss was -14.6% when I finally closed the position at 9:48am on Oct 04. I

should have closed Oct 03, but I was busy with the deposition. This loss is

so big, it wipes out all my profits since March. Ouch!

On Aug 29

I wrote, “the red

line came very close on Aug 25, … I think I’ll skip the contrarian trade on

the next downswing.” Well, I should have stuck with that idea, which would

have postponed the start of this trade until Sep 20 (three weeks after the

almost-hit on the red line), which I believe would have reduced the total

loss to -5.0%.

On Sep 07 I

wrote, “I’m

expecting another bounce at the dashed orange line”. Wrong! We fell to

that line on Sep 20, then gapped down rather than bouncing upward; this was

followed six days later by a bounce-down from the underside of the orange

line — which is extremely bearish. Note that price spent some time

below the lower blue line, then crossed the channel but did not hit the

upper blue line, then fell to new lows. This is my “crash signal”.

Also on Aug 29 I mentioned that there was a “4-month-wide

head-and-shoulders” pattern, which has completed. Unless something drastic

happens, that dashed orange line should act as a lid on prices for several

months, maybe until spring. It’s amazing how much predictive value that

line continues to have (it’s pinned to the Silicon Valley Bank bankruptcy

in March).

My bearish imaginary bet: That bullish trade ended with a ‘capitulation’, which suggests that I should immediately bet the opposite way. So I bet 100% of capital at the open on Oct 05 that the market will be going down. Of course, it immediately went up! But Friday is often the most bullish day of the week and Friday’s high was still below the EMA(10) average (shown here as a solid blue line). I plan to wait 4 days (until Tuesday) and then start using the EMA(10) as a daily trailing stop. If price is already above that on Tuesday that I’ll cancel this trade with another loss. Shit happens.

War: Meanwhile, Hamas has decided to invade Israel. What effect will that have on the US stock market? I’m guessing a ‘paradoxical’ rise on Monday, but not much else — I think this market really wants to do an October crash and doesn’t care about the rest of the world right now. But we’ll see.